Using UX research to discover if a business has a viable MVP

This case study is for a real paying client at thestartupfactory.tech in October 2019, but the names of the business and the people are changed for anonymity.

A small business owner, Billy, came to us to see if we could turn his profitable 1-man band into a viable tech product business. "Loans 'r' Us" helps other small businesses secure funding for various needs.

Before jumping into a tech build, I convinced Billy to commit to a short piece of validation work. Less than 1 week to answer the question:

Can we turn Loans 'r' Us into a viable tech product business?

Overview

First an overview of the roles I assumed, the skills I used, and the team I assembled for the job.

Roles

- UX Consultant

Timeline

- 1 week

Skills and techniques

- Project planning and management

- UX research

- Remote user interviews

- User personas

- Customer journey mapping

- Workshopping

- Final report

Planning and research goals

After an initial conversation with Billy, I wanted to understand the problem domain better, then capture and communicate my findings back to Billy. Finally, the goal was to identify possible opportunities that could produce a viable Minimum Viable Product (MVP).

I did this by planning a series of activities:

- Conduct user interviews

- Capture user archetypes and Jobs, Pains, and Gains

- Capture customer journey maps

- Host an opportunity workshop

Each stage was designed to consolidate information I had discovered, replay it to Billy for confirmation or adjustment, before carrying on to the next. The final workshop is based my experience with the Design Sprint, to use everyone's collective knowledge to find areas of highest value to investigate further.

Even though I already have a main goal of identifying if we could create a tech product business, I always recommend using hypotheses to guide the research.

My hypothesis was:

H1: Billy's clients want to use a productised version of Loans 'r' Us.

and the null hypothesis:

H0: Billy's clients do not see value in a productised version of Loans 'r' Us.

Understanding the problem domain

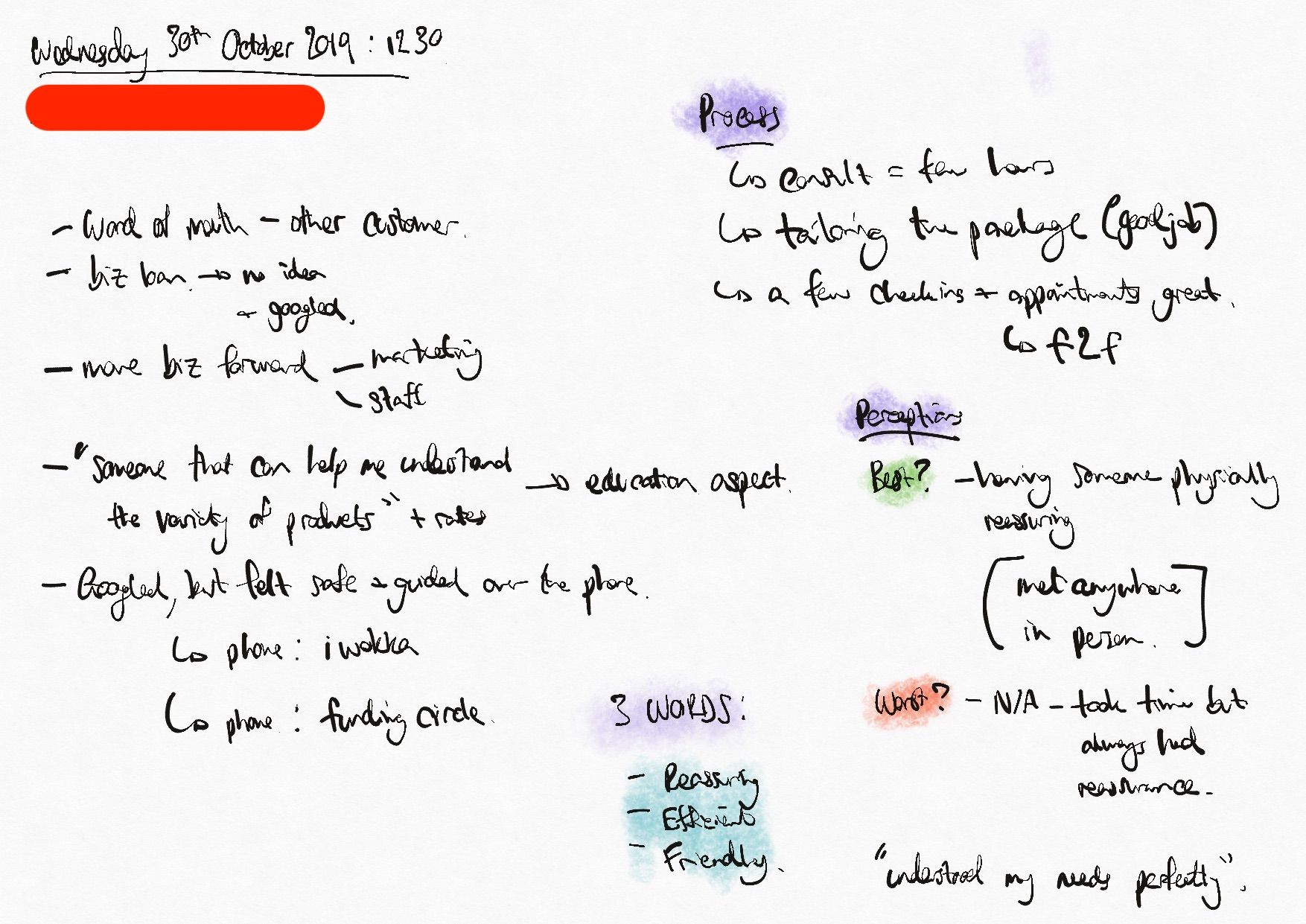

User interviews

Why: user interviews are a quick, cost-effective method of understanding the business, Billy's client's perspective, and I can ask open ended questions.

I interviewed 2 of Billy's customers who were available, as well as Billy himself.

My questions were:

- How did you come across Loans 'r' Us?

- What did you originally contact Billy for?

- Can you tell me about the process end-to-end with Billy?

- What was the best thing about working with Billy?

- How about the most challenging thing?

- Can you describe Loans 'r' Us in 3 words please?

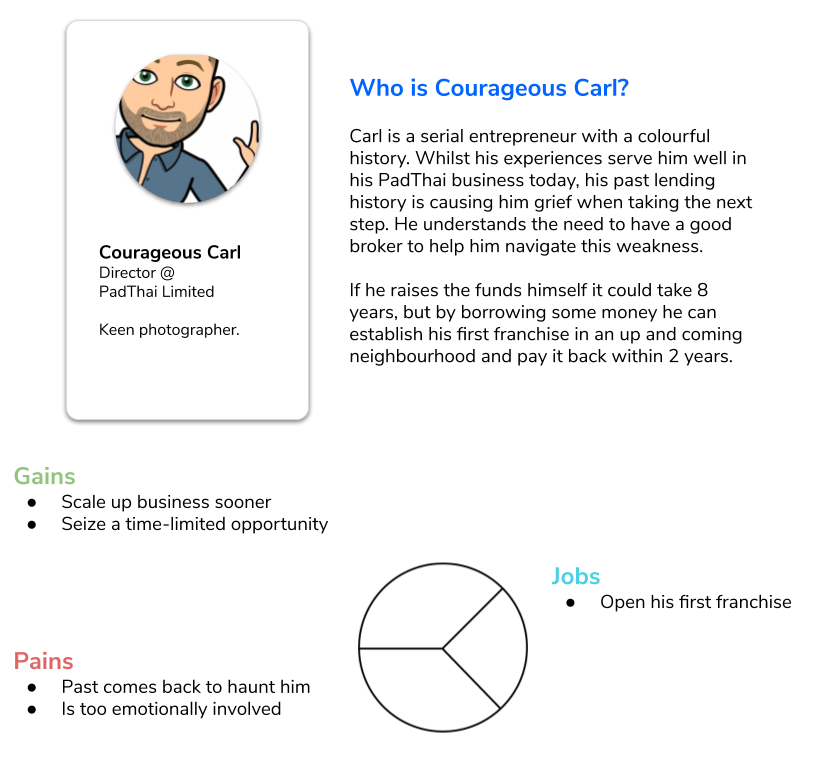

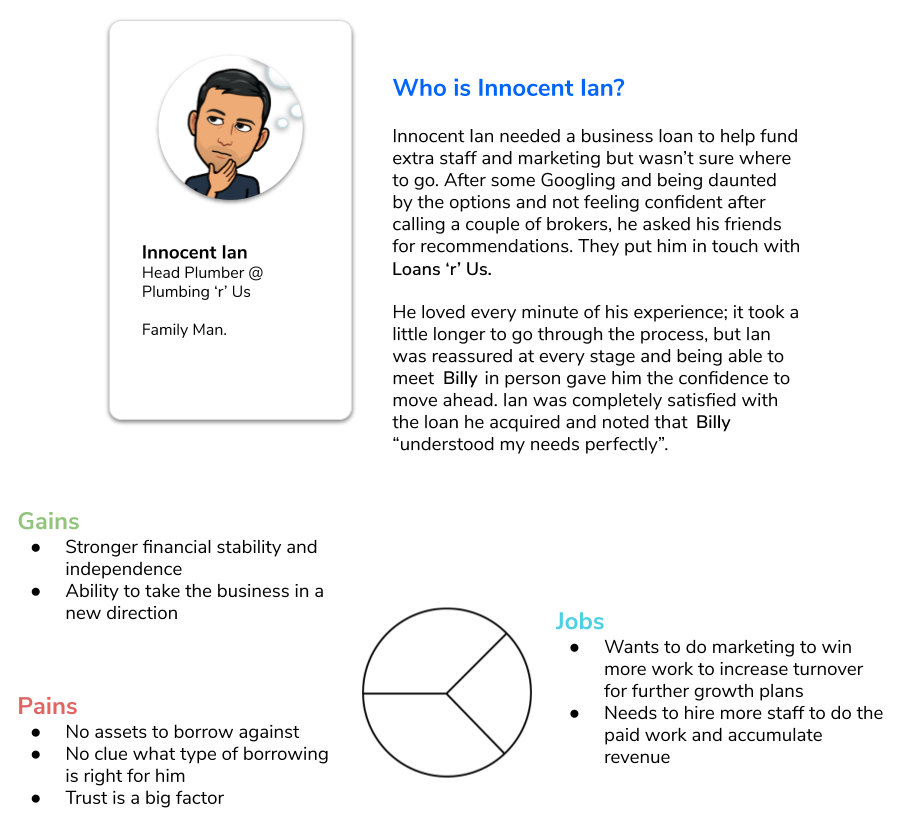

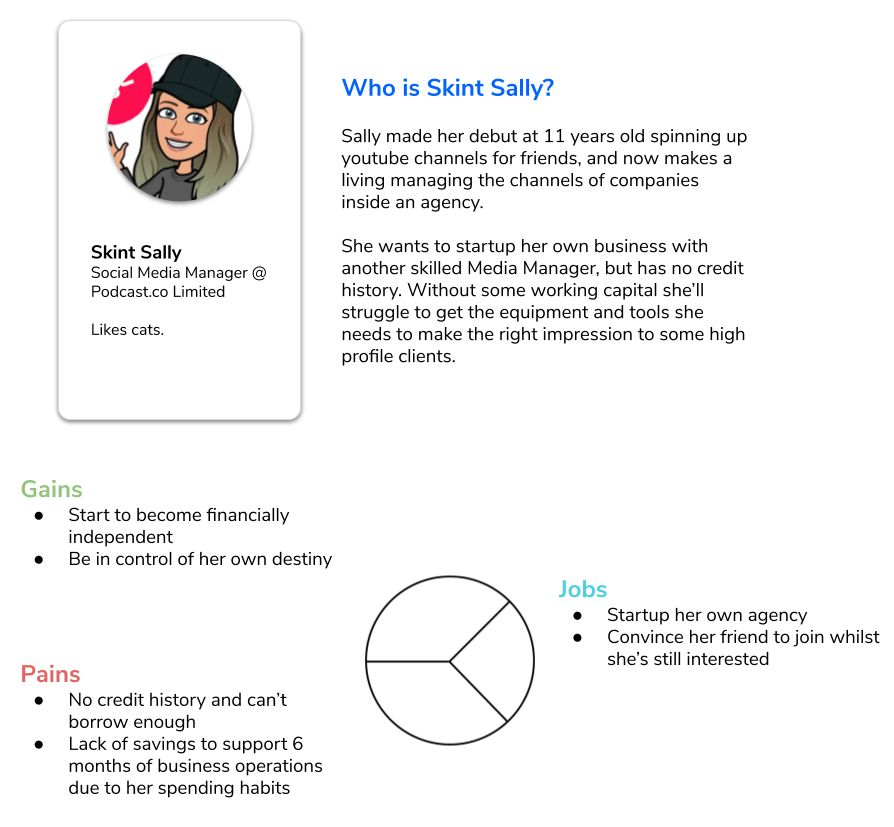

User archetypes

Why: I wanted a concise, memorable method of discussing who Billy's customers are and what their motivations are.

Using the information I had gathered, I was able to distill 3 user archetypes that represented the 3 types of customers Billy had. Each have their own needs from Billy, and financial needs.

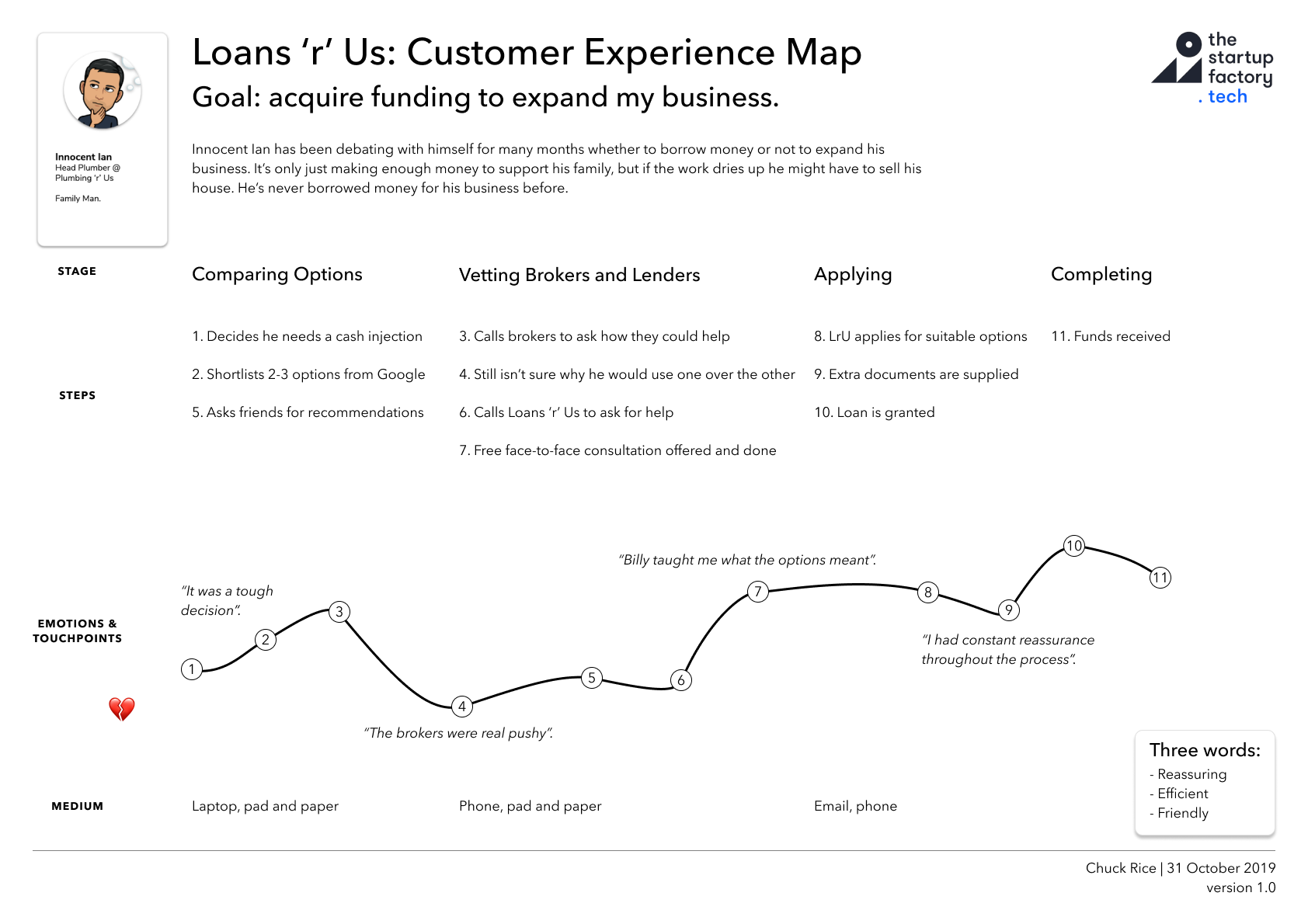

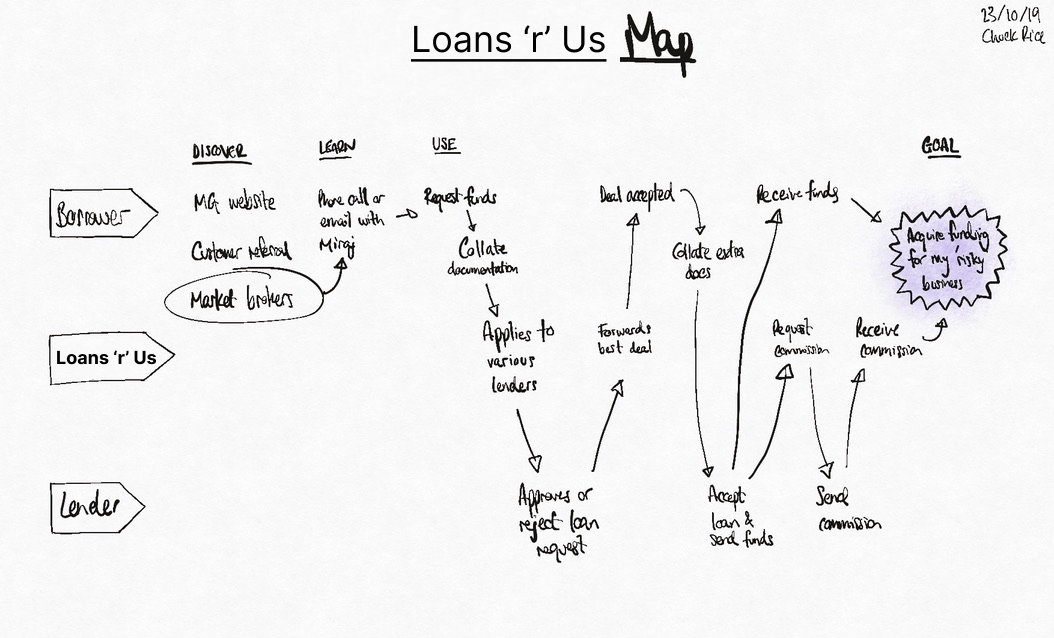

Customer journey maps

Why: as well as understanding the customers profiles, I want a clear concise way to understand their experience with Loans 'r' Us.

I created 3 maps: 2 were based off the interviews I ran, and 1 was from Billy's perspective.

Here's one example:

Identifying opportunities

Why: use the best-hits from the Design Sprint process, to identify opportunities that Loans 'r' Us could pursue with us.

I printed off all the deliverables, created a basic map, and invited everyone to a dot-voting exercise. This helped me identify clear themes or starting points we could work from.

Outcomes

Ultimately I concluded that there was not a viable tech product business for "Loans 'r' Us", and we did not proceed to a build. This was due to all of Billy's customers preferring the person-led approach from Billy himself.

Therefore, I accepted the null hypothesis.

I did however identify 3 key themes or starting points, where technology and off-the-shelf software could help scale up Billy's business instead:

- A “Compare The Market” for Business Loans—while possible, it's not for Billy's existing customers and wasn't their main pain point

- Workflow Management & Automation—to scale up Billy's workflow

- Financial Education for SME’s and Sole traders—to answer Billy's clients' questions in a scalable way

In addition, I wrote and shared a full report of work undertaken.